The real estate crisis in the data of public companies

After the Corona, the real estate market in Israel experienced a meteoric rise in prices and became a kind of real estate bubble that grew to astronomical dimensions and is now actually exploding everywhere and affecting all the sectors concerned. Confused? We are here to “make order for you”.

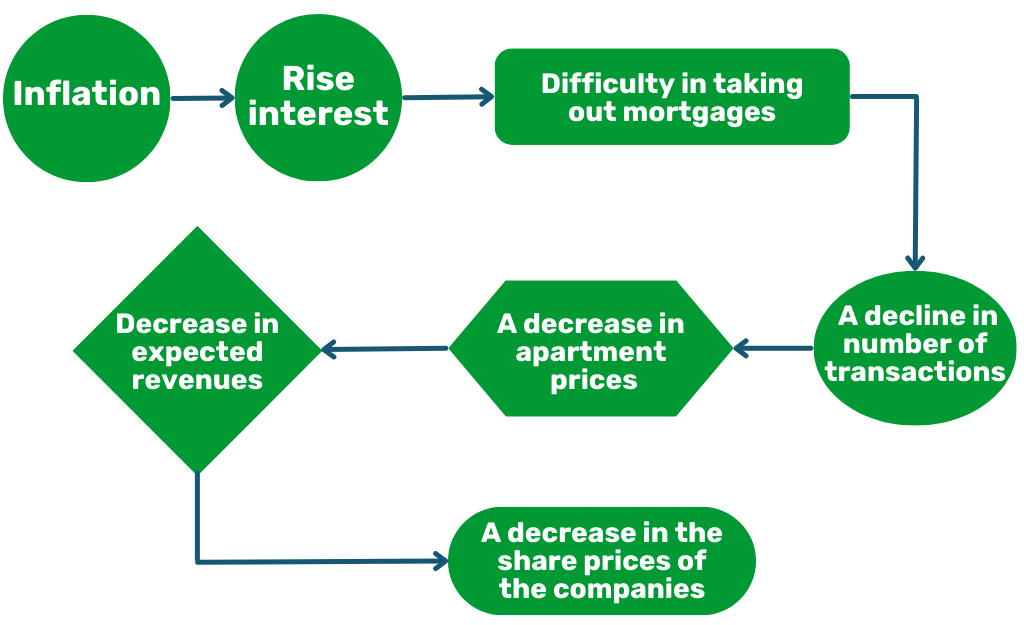

It started with the continuous increase in interest rates, went through a decrease of tens of percent in the volume of transactions in the market and led to a decrease, for the first time in a long time, in the prices of apartments and the value of yielding properties.

A summary review in the field of residential initiation and construction, which includes the data of 25 public real estate companies, shows that the summary of the aggregate sales of all companies shows an average decrease of 36% compared to 2021, meaning that this is a horizontal downward trend for almost all companies.

The crisis in the housing market, which mainly stems from the continuous increase in interest rates in the economy, is also beginning to give its signals in the reports of the public real estate companies for the first quarter of 2023. If for a long period of time we have only become accustomed to increases in the value of projects and real estate assets, then in the reports summarizing of 2022 we began to see the first signals that continued in the new reports of 2023 that were recently published and now we can say with full mouth that this is definitely a trend.

The increase in interest rates in the economy affected three main factors in the real estate market:

1. Investors have stopped investing in the field and are looking for other investment alternatives.

2. First home buyers are waiting “on the fence” to see how the rise in interest rates will affect mortgage repayments.

3. Housing developers are also waiting for the economic situation to clarify.

The current situation in the market will lead to a drop in prices, but the more significant damage is the fact that quite a few entrepreneurs – especially the medium and small ones – will run into cash flow difficulties. Entrepreneurs who took large loans from banks and financing funds are already having difficulty selling apartments and will not be able to meet the loan repayments. The banks, for their part, are tightening their belts, already today, and are not giving credit to these companies.

It is estimated that small and medium-sized real estate companies will soon fall into economic distress and even collapse. All of this can directly affect the entire large circle of suppliers that work in the field.

Let’s summarize and say that we are in a definitely challenging time – after years of price increases in the real estate market, we are now witnessing a change in trend and price decreases.

These declines open the door to a variety of new and interesting purchase opportunities for those who are ready for them ahead of time.

* The above should not be considered as investment advice, a recommendation or an opinion regarding the viability of the investment and it is not a substitute for advice that takes into account the data and the personal needs of each person.